Professional, experienced with a well researched portfolio are some of the traits which characterise the West End Group who are always friendly and efficient. They make me money too!

Think a financial adviser is only for someone nearing retirement? We’d encourage you to think again.

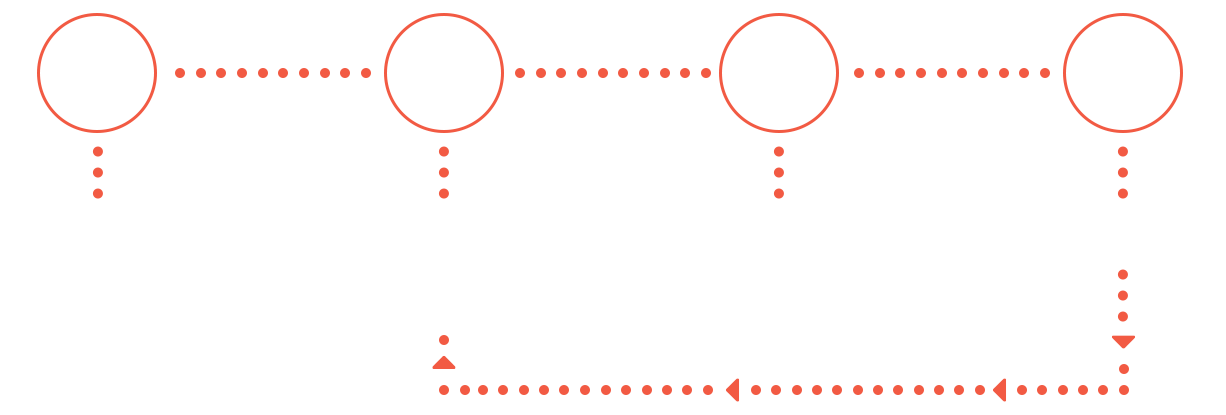

We believe that the best type of financial planning begins early. That way you’re not only ahead of the game when planning for retirement – but you’re also setting clear financial goals so that you can comfortably afford all of life’s other adventures along the way.

There are many ways in which a financial adviser can help you navigate the journey, from advice on superannuation, to budgeting, saving for your wedding or first home, regrouping your finances post-divorce, or freeing up money for your children’s university fees or that long European trip you’ve always dreamt of.

From saving for a house, to budgeting for a baby, starting a business, investing or planning for retirement, we know that every life journey is different.

However, while everyone has different goals and aspirations, we believe that the best things in life usually don’t just happen. You have to make them happen, by making concrete plans of how you’ll get there. We call this process the business of life.

At West End Group, we’re here to help provide a tailored strategy to reach your financial goals, so you can get on with the business of enjoying life – while knowing your financial future has been expertly taken care of.

Our Financial Knowledge Centre is a very comprehensive resource of useful information about investing and the rest of the business of your life, organised into easy bites.

There’s a great selection of videos included, along with more detailed learning modules, articles, a jargon-buster, some useful financial claculators (such as a budget planner) and even some fun quizzes.

Professional, experienced with a well researched portfolio are some of the traits which characterise the West End Group who are always friendly and efficient. They make me money too!

The professionalism of Robert and the employees in his office, in preparing the synopsis of our position from our phone call, only serves to reinforce our confidence in Westend Group.

When deciding to have our investments professionally managed there were a number of key areas that we needed to address

1. Establishing our risk profile to determine future planning and investments 2. Ensuring a regular income from our investments with access to additional funds if required. 3. Scheduling detailed portfolio reviews to monitor our overall finances.

Westend Group, through Robert Chester, has enabled us to achieve our objectives and the results have been fully up to our expectations.